Audio CDs (3) of the Real Estate Principles Textbook - $29.95 may be purchased through the American Schools ONLINE Catalog at: http://americanschoolsonline.com Listen to sample audios at: http://americanschoolsonline.com/audio

SHORT

INTRODUCTION TO CALIFORNIA REAL ESTATE PRINCIPLES,

© 1994 by Home Study, Inc. dba American Schools

Click on link to go to:

Table of Contents; Chapter I: Real Property; Chapter II: Legal Ownership; Chapter III: Agency & Ethics; Chapter IV: Contracts; Chapter V: Real Estate Mathematics; Chapter VI: Financing; Chapter VII: Mortgage Insurance; Chapter VIII: Appraisal; Chapter IX: Transfers of Real Estate; Chapter X: Property Management; Chapter XI: Land Control; Chapter XII: Taxation; Chapter XIII: Fair Housing Laws; Chapter XIV: Macroeconomics; Chapter XV: Legal Professional Requirements; Chapter XVI: Notarial Law; Chapter XVII: Selling Real Estate; Chapter XVIII: Trust Funds Handling; Glossary; Index.

Chapter V: Real Estate

Mathematics

Educational Objectives:

Learn about Interest Computation and Tables,

Three-Variable Formulas, Prorations,

R. E. TERMS GLOSSARY, INDEX.

(The following is reprinted by permission

from the CalBRE Reference Book, p. 263-269, 783-792)

The practice of real estate requires almost

daily calculations of mortgage interest and principal, monthly payments,

prorations, square footage, yields and similar basic math computations.

Although most computations today are done with computers through the use of

specially designed software programs or with a hand-held calculator/computer

while using convenient charts showing needed tables and formulas, the real

estate licensee should know how to solve common problems relating to real

estate without benefit of a calculator, since he or she may encounter

situations requiring math solutions when no electronic assistance is available.

INTEREST COMPUTATION

AND TABLES

Simple interest

computation involves multiplying the principal (amount of note) by the selected

interest rate and the product or result is the interest for one year. Remember,

the interest rate (.06 or .09 for example) is a decimal and two points are to

be marked off from the right.

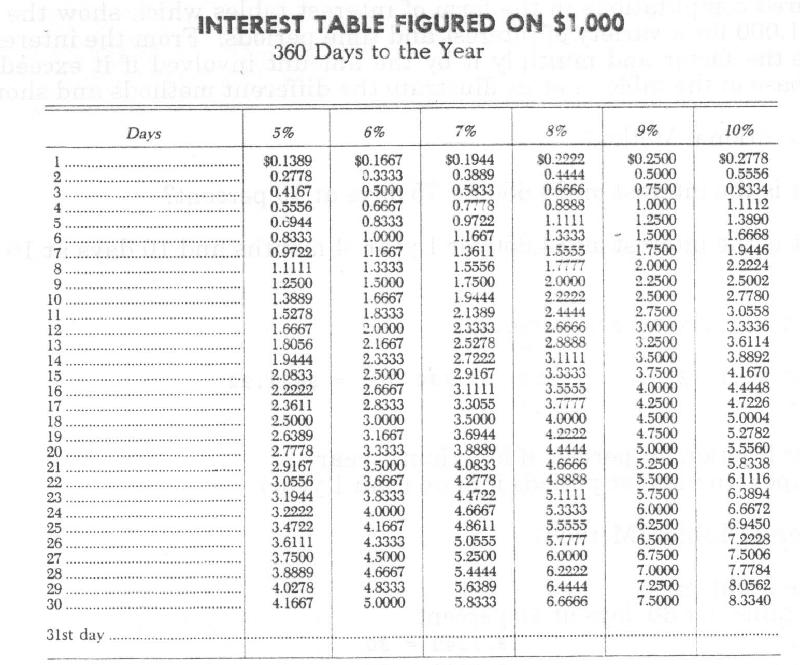

There are 12 months in a year or 365 days. This

latter figure makes for an awkward denominator. As a result, as an acceptable

business practice, we assume 12 months of 30 days each, or 360 days to a year.

To avoid long computations which may involve

cumbersome fractions, it is common to use prepared computations in the form of

interest tables which show the base as $1, $100 or $1,000 for a variety of

interest and time periods. From the interest table, we determine the factor and

multiply it by the amount involved if it exceeds or is less than the base of

the table. Let us illustrate the different methods and short cuts:

Long Conventional Method

a. What is the interest on $4,650 for 75 days at

10 percent?

b. What is the interest on $4,650 for 1

year, 4 months and 10 days at 10 percent?

Answer:

(a) 4650 X .10 X 75/360 = $96.88

|360|

(b)

4650 X .10 X |120|

or 490/360 = $632.92

|

10|

(Proper fraction for periods if less than 1 year)

(Improper fraction for periods if more than 1

year)

Use of Interest Tables (Method)

(a) Same problem

Look in table for 30 days at 10 percent

factor is 8.3340

= 30

factor is 8.3340

= 80

factor for 15

days 4.1670

= 15

20.835075

days

$4,650 = $4.65 per

$1,000

Multiply

$4.65 X 20.8350

= $96.88

(b) Table not complete

to show higher factors, but it could be done this way:

30 day factor 8.3340

X16 (16 months)

133.3440

+

2.7780

(10 days)

136.1220

factor for 1 year, 4 months and 10 days at $1,000

136.1220

X4.65

(to get additional thousands)

632.92 Answer

OTHER SHORTCUT METHODS FOR COMPUTING SIMPLE

INTEREST

4%: Multiply the principal by number of

days; cut off right- hand figure and divide by 9.

5%: Multiply by number of days and divide

by 72.

6%: Multiply

by number of days; cut off right-hand figure and divide by 6.

7%: Compile the interest for 6% and add

1/6.

8%: Multiply by number of days and divide

by 45.

9%: Multiply

by number of days; cut off right-hand figure and divide by 4.

10%: Multiply by number of days and

divide by 36.

Bankers 12%-30 day/6%-60 day interest

computation method (Using 360 day

year). To find interest on any principal

amount for 30 days at 12%, or for 60 days

at 6%, simply move the decimal point in

the principal amount two places to left.

What is the interest amount on $8432.67

at 12% for 30 days?

Answer: $84.33

What is the interest amount on $8432.67

at 6% for 60 days?

Answer: $84.33

(Since 12% per annum is 1% a month, and

1% of any number is the hundredth

part of it, then by pointing off two

places from the right of a number, it is in effect divided by 100.)

What is the interest on $7,397.64 at 9%

for 69 days?

Interest @ 6% for 60 days = $73.98

(move decimal two

places to left)

Interest @ 3%

for 60 days = $36.99

(1/2 of 6% amount)

Interest @ 9% for 60

days = $110.97

We still need 9 days

more interest; so

6 days = 1/10 of 60 days 6 days =$11.09

(1/10 of $110.97)

3 days = 1/2 of 6 days 3

days = $5.55

(1/2 of $11.09)

Interest @ 9% for 69

days=$127.61

SOME

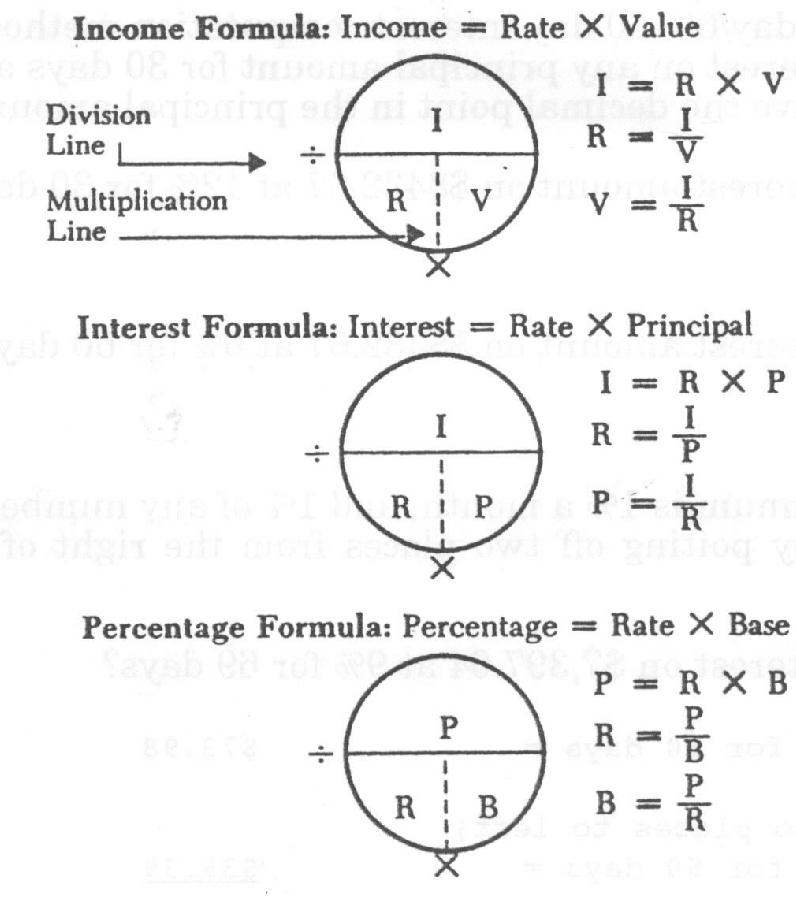

HANDY FORMULAS

In three-variable formulas, one variable is

equal to the other two. Place one variable in the top half of an imaginary

circle. Place each of the other two variables in adjacent quarters in the

bottom half of the circle. Divide the circle horizontally by a diameter line.

This is a division line (/).Divide the bottom quarters of the circle vertically

by a radius line. This is a multiplication line ( X ). To find the unknown

variable, cover with finger the unknown variable and complete the calculation.

Other three-variable formulas:

Area = Length X Width (A = L X W)

Tax = Assessed Value X Rate (T = A X R)

Commission = Sales Price X Rate (C = S X R)

LINEAR AND SPATIAL MEASUREMENTS AS USED

IN APPRAISING AND LAND DESCRIPTIONS

Common Linear Measurements

One yard = 3

feet or 36 inches. One rod = 16 1/2 feet, 5 1/2yards

One furlong = 40 rods

100 feet = 6.6 rods

One mile = 5,280 feet, 1,760 yards, 320

rods, 80 chains

Surveyors' Measurements

1 link = 7.92 inches;1 rod = 25 links;1

chain = 4 rods, or 66feet.

(These are the old surveyors' measurements.

Modern surveyors use a steel tape or what is called an engineer's chain which

is 100 feet long with links of one foot. Thus, a mile measured by a modern

steel tape chain is 52.8 chains.)

Spatial or Area Measurements (Length X Width)

1 square foot = 144 square inches

1 square yard = 9 square feet

1 square rod = 30 1/4 square yards

1 acre = 10 square chains, 160 square

rods, 4,840 square yards,43,560 square feet

(An acre is an odd and inconsistent measurement.

It is supposed to have been the amount of land that a farmer could plow in a

day with oxen and the old wooden plow. As a square, it is approximately 208.71

feet on a side.)

A section = 1 square

mile, 640 acres

A quarter section = 160 acres

Area of a square or rectangle = length X width

in unit of linear measurement used

Area of a triangle = base X 1/2 altitude

Cubic Measurements (Length X Width X Height)

1 cubic foot = 1,728 cubic inches

1 cubic yard = 27 cubic feet

SOME METRIC EQUIVALENTS

LENGTHS

one foot = 0.3048 meter

one yard = 0.9144 meter

one mile = 1.6093 kilometers or 1609 meters

one meter = 39 inches one kilometer = 3281 feet

or .62 miles or 1000 meters

AREAS

one square foot = 0.0929 Sq. meter

one square yard = 0.836 sq. meter

one acre = 4068.8 sq. meters

one square mile = 259 hectares or 2.59 sq. km.

one square meter = 10.76 sq. feet

one hectare = 2.47

acres or 10,000 sq. meters

Principal -Interest - Rate ?Time

Principal is the amount of money on which

interest is paid usually the loan amount. In a sense, interest is the

"rent" paid by a borrower of money to a lender of money for the use

of the money. It is the cost of borrowing money. Interest is term ed

"simple or "compound.” Simple interest is interest paid only on the

principal owed; compound interest is interest paid on accrued interest as well

as on the principal owed.

The basic simple interest formula used in

finance has four components: interest, principal, rate and time.

I = P X R x T or I = PRT

1.Interest (cost of borrowing

expressed in dollars money paid for the use of money).

2. Principal

(amount of the loan in dollars on which the interest is paid).

3. Rate

(cost of borrowing expressed as a percentage of the principal paid in

interest for one year).

4. Time

(length of time of the loan usually expressed in years).

One must know what three of these four

components are in order to compute the fourth (and unknown) component.

1. Interest

Unknown - Interest = Principal x Rate x Time or I = PRT.

Example: Find the interest on $2500 for 7

years at 13%.

I = PRT

I = $2500 x . 13 x 7

I = $325 X 7

I = $2275

2. Principal

Unknown - Principal = Interest divided by Rate x Time

or

P = I/RxT.

Example: How much money must

be loaned to receive $2275 interest at 13% if the money is loaned for 7 years?

a.

P=I/RT c.P

= $2275/.91

b.

P=$2275/.13x7 d.P

= $2500

3.Rate Unknown Rate = Interest divided by

Principal X Time

or R=I/P X T.

Example: In seven years $2500 earns $2275

interest. What is the rate of interest?

a.

R=I/PT c.

R=$2275/$17,500

b.

R=$2275/$2500x7d. R=.13 or 13%

4. Time Unknown - Time = Interest divided

by Rate x Principal or

T=I/RxP

Example: How long

will it take $2500 to return $2275 interest at an annual rate of 13%?

a.

T=I/PR c.

T=$2275/$325

b.

T=$2275/$2500x.13 d.

T=7 years

Compound interest is more common in advanced

real estate subjects, such as appraisal and annuities. Compound interest tables

are readily available but the principle is discussed here.

As previously stated, compound interest is

interest on the total of the principal and its accrued interest. For each time

period, called the conversion period, interest is added to the principal to

form a new principal amount and each succeeding time period has an increased

principal amount on which to compute interest. Conversion periods may be

monthly, quarterly, semi-annual or annual.

The compound interest rate is usually an annual

rate and must be changed to "interest rate per conversion period" or

"periodic interest rate. " To find compound interest (interest on

interest) the formula for simple interest of I = PRT is used but the symbol

"i" is used instead of RT, "i" being the annual interest

rate divided by the conversion periods per year; so I = Pi.

Example: A $5000 investment at 12% interest

compounded annually for 3 years earns how much interest at maturity? Solution :

Using I = Pi

I = $5,000 X (.12/1)

First year's I =

$5,000 X . 12 or $600.Add to $5000 principal.

Second year's I =

$5,600 x .12 or $672.Add to $5,600 principal.

Third year's I =

$6,272 X . 12 or $752.64.Add to $6,272 principal.

At maturity borrower will owe

$7,024.64.Loan has earned interest of $2,024.64 in 3 years.

Example: How much interest will a $1,000

investment earn over 2 years at 16% interest compounded semi-annually? Solution:

Since the conversion period is semi-annual, the interest rate is computed every

6 months. The periodic interest rate is 16% divided by two conversion periods:

i = 8% for the calculation: I = Pi

1.Original principal amount$1,000.00

2.Interest for 1st period

($1,000X.08) 80.00

3.Balance beginning 2nd period1,080.00

4.Interest earned for 2nd period ($1,080

X .08) 86.40

5.Balance beginning 3rd period1,166.40

6. Interest for 3rd period ($1,166.40 X

.08)93.31

7. Balance beginning last period1,259.71

8. Interest for last period ($1,259.71 x

.08)100.78

9.Compound principal balance1,360.49

I

for 2 years = $1,360.49 - $1,000 or $360.49.

The same problem using annual simple

interest results in $40.49 less interest for the lender ($1,000 X .16 X 2) =

$320 simple interest.

Obviously no one in actual practice is

going to go through the tedious process outlined above to calculate compound

interest. Instead standardized compound interest tables will be used to give

the answer quickly.

The exact formula for computing compound

interest is:

S

= P (1 + i)n

S

= the compounded amount, principal and interest, or accumulated value-the Sum

P

= the original principal amount or present value of S

i

= the rate of interest per period

n

= the number of conversion periods in the term or periods in which the

principal is compounded.

To illustrate this formula, suppose you

deposit $100 in a savings account paying 6% interest compounded quarterly. In

this case,

S=compounded

sum being sought

P=$100

i

= 1 1/2% or .0150 (the interest per period, the rate being 6% per year divide 6%

by 4 to get the quarterly rate)

n

= 4 (the number of conversion periods in the problem)

S

= P (1 + i)n

S

= 100 (1 + . 0150)4

S

= 100 (1.0150) (1.0150) (1.0150) (1.0150)

S

= 100 (1.0613634)

S

= $106.14

The total interest is $6.14 ($106.14-$100.00).By

solving for simple interest, the interest on $100 at 6% per annum is only $6.00.

Licensees should become well versed in

using these symbols, formulas and compound interest tables to be able to

calculate annuity payment values (mortgage payments, rents), sinking fund needs

(accumulation of money in equal periodic deposits at compound interest to meet

obligations, such as replacing depreciated assets or debt retirement) and

compute amortizations.

Effective Rate of Interest

he "nominal" or

"named" interest rate is that rate of interest stated in the loan

documents, while the effective interest rate is the rate the borrower is

actually paying, commonly called the annual percentage rate (APR).In other

words the loan papers may say one thing but the result is another, depending

upon how many times a year the actual earnings rate is compounded. The

effective rate of interest = the annual rate which will produce the same

interest in a year as the nominal rate converted a certain number of times. For

example, 6% converted semi-annually produces $6.09 per $100; therefore, 6% is

the nominal rate and 6.09% is the effective rate. A rate of 6% converted

semi-annually yields the same interest as a rate of 6.09% on an annual basis.

When the loan proceeds disbursed by the

lender are less than face value (the original principal sum stated in the

promissory note), the lender has deducted "up front" a loan fee and

perhaps discount points as compensation or remuneration for making the loan on

the agreed terms. The borrower thus receives less than must be repaid under the

contract. This lending practice is called "discounting. " Sometimes

under a bank's commercial loan terms the total interest is deducted in advance

from the principal amount of the loan before the loan proceeds are given to the

borrower. This method is usually associated with short-term bank loans, but

real estate lenders also discount loans by collecting "points" in

advance to increase yield.

When more accurate yield and interest

tables are unavailable, it is possible to approximate effective interest cost

to borrowers or a yield rate to a lender by using the following formulas where

discounted loans are involved:

i = approximate effective interest rate

(expressed as a decimal)

r = contract interest rate (expressed as

a decimal)

d = discount rate, or points deducted

(expressed as a decimal)

P

= principal

of loan (expressed as the whole number 1 for all dollar amounts)

n = term (years, periods, or fraction

thereof)

The formula for approximating the

effective rate of interest on a discounted real estate loan may be written:

i = r + (d/n)/(P-d)

Example:

What is the estimated approximate

effective interest on a $60,000 mortgage loan, with a 20 year term, contract

rate of interest being 12% per annum, discounted 3%, so that only $58,200 is

disbursed to the borrower?

i

= .12 + (.03/20)/(1-.03) = .12 + (.0015)/.97 = .121546 or 12.15%

Where published yield tables are

available, both the tables and the above formula should be compared, especially

when tables do not have fractional interest rates or uncommon terms. By

interpolation, errors in approximating the result can be minimized.

Principal-Plus-Interest. Another manner

of figuring interest is the Principal-Plus-Interest or the "interest

extra" approach. Here the borrower makes a fixed payment on the principal

each time plus paying the interest on the unpaid balance. Since the interest is

different each time, the total payment is different each time. This method is

not widely used in California in the case of first mortgages or trust deeds. It

is occasionally found in the case of secondary financing.

Straight Loan. This is an arrangement

where the principal of the loan is paid off in one lump sum rather than

periodic payments. This lump sum payment is usually made when the loan becomes

finally due. It is normal, however, that the interest payments be made at

intervals during the term of the loan.

Extended Term Amortization. Often in

commercial and industrial real estate loans with a very stable and secure

tenant the amortization payments are based on a payment schedule that is longer

than the actual term of the loan.

For example, the actual term of the loan

may be 25 years, but the monthly amortization payments may be based on a term

of 30 years. Obviously when the term of the loan ends there will be a balance

to be paid off in a lump sum or "balloon payment."

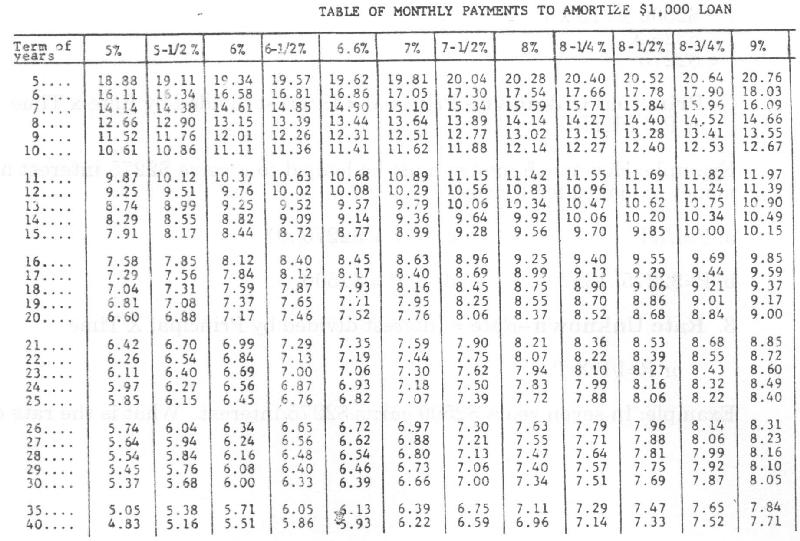

Computers Tables Formulas. The

mathematics of financing is generally done with appropriate mortgage tables and

formulas and with the computations completed by hand-held high-speed

calculators.

Courses in instruction in the use of

calculators, computers and the sophisticated tables and formulas in general use

are available in most communities.

There are some expenses connected with

owning real estate that are commonly paid for in arrears or in advance. For

example, fire insurance premiums are normally paid for in advance. Landlords

usually collect rents in advance, too. On the other hand, mortgage interest

accrues in arrears. Taxes, however, may be paid in advance or in arrears,

depending on the time of year of sale. Real property tax adjustment (proration)

depends on a number of things, such as: date current installation of taxes is

due? What portion of year's taxes has seller paid, is the escrow closing at a

time of year when current tax bill has not yet been issued by the tax

collector, and, if so, should the parties consider the possibility that the tax

bill will substantially increase over the preceding year and agree to a further

adjustment between themselves when the new tax bill is available?

When a property is sold, a portion of

these expenses has usually been used up by the seller and are rightfully an

expense of the seller. However, often a portion of the expenses of ownership

has not been used up and when the title to the property is passed on to the

buyer, the benefit of these advances will accrue to the buyer. It is only fair

that the buyer, therefore, reimburse the seller for the unused portions of

these expenses of homeownership.

These adjustments are normally made by

the process of proration. This simply means apportioning the expenses (or

benefits) fairly to each party.

For example, if the seller sells the

property six months after paying the annual fire insurance premium, 1/2 has not

been used up and will accrue to the benefit of the buyer. In this case, the

buyer should pay 1/2 of the insurance premium to the seller. This example is

over-simplified, of course. In practice, prorations are figured down to the day

with the so called Banker's rule of 30 days to a month and 360 days to a year

usually applying.

Taxes. The real property tax year runs

from July 1 of one year to June 30 of the following year (fiscal year).Taxes may

be paid in one or two installments. The first installment is due November 1.

The second is due February 1.The entire bill may be paid at the time the first

installment is due. Suppose an escrow for the sale of a small residence closed

January 16.Taxes for the full year in the amount of $600 are to be prorated as

of close of escrow between buyer and seller. How much should the buyer be

charged in escrow to reimburse the seller for advance paid taxes?

Taxes are paid through June 30th.Buyer

will owe seller for 5 1/2 months tax adjustment.$600/12 = $50/month.5 1/2 x 50

= $275 due seller.

Insurance. Fire insurance rates are

usually quoted at so much per $100 of coverage per year. Assume the rate is 95

cents per $100. For a $47,000 insurance policy paid in advance to March 31,

what will be the buyer's reimbursement to seller in the above escrow if the

insurance premium is an annual premium and adjustment is as of close of escrow?

Premium = $. 95 x 470 = $446. 50

Remaining days under policy = 75 days

$446.50/360 days = $1.24/day

$1.24 x 75 = $93 due seller.

Rents. Suppose the seller of a

single-family dwelling rented it for $450 a month. Rent was to be adjusted in

escrow as of the closing date of May 1.Rent is paid on the 25th of each month,

and the tenant is current in paying rent. Who is to be charged and credited in

the escrow on the rent adjustment? What is the amount of the adjustment?

Rents are paid in advance. Seller has

collected rents to May 25. Escrow will debit seller and credit buyer as follows:

$450/.30 = $15/day

24 (days of the adjustment) x $15 = $360

credit to buyer.

Mortgage

Interest. The buyer is purchasing a home subject to two assumable trust deeds

of record. Interest is to be prorated between buyer and seller as of close of escrow.

Both loans are current. Escrow closes on the 21st day of the month. The first

trust deed has an unpaid principal balance of $59,200, monthly installment

payments are $711. 54 including interest at 11. 5%. Payments are due the first

of each month. The second trust deed unpaid principal is $11,700, principal and

interest monthly payments are $200 per month, interest is 13% per annum,

monthly installments are due the 24th day of each month. Whose account is

credited for interest in the escrow?

First

trust deed Second

trust deed

51

21

days 21

days (closing

(closing

date) date)

-1

day -24

days

(interest

due date) (interest

due date

20

days of 27

days of

interest

owed interest

owed

by

seller by

seller

$59,200

x .115/360 $11,700

x .13/360xx 20 = $378.22, 27

= $114.08,

credit

buyer and credit

buyer and

debit

seller. debit

seller.

Taxes

and Assessments. As of June 1978 a limit on real property taxation was set by

constitutional amendment. This limitation is one percent of "full cash value"

(market value) plus a maximum authorized two percent annual inflationary factor

and an additional sum (averaging 1/5 to 1/4 of one percent) to pay for any

existing indebtedness on affected property, approved by voters prior to the

passage of the amendment.

In computing the tax to be paid on California

real property for the 1978-79 and subsequent Assessment Roll years, the

following is to be considered:

(1) the "full cash value" of the

property established as of (a) the lien date of the 1975 base year, or (b) the

date a property is purchased, newly constructed, or has a change of ownership,

after the 1975 lien date; (2) the maximum two percent inflationary factor

applied to the base value, which inflationary (cost of living) factor is to be

added to the base year value for each lien date after the lien date on which

"full cash value" is determined; (3) an additional amount may be

added to pay for any bonded indebtedness previously approved by the voters,

which amount will vary from county to county and will not be applicable to all

parcels.

For example, a county tax bill may be computed

as follows: assume an appraised value of $57,000; deduct homeowner's exemption

of $7,000, leaving $50,000 as amount taxable; multiply that amount by the tax

rate of .012 (1% tax limit plus two-tenths of one percent allowed for bonded

indebtedness); the resulting tax bill is $600. 00.

Because real property is reassessed as a result

of incidents of transfer (unless the transfer is subject to a statutory

exemption), a supplemental tax assessment is usually imposed by the county assessor.

This supplemental assessment increases the taxes due for the remainder of the

fiscal year within which the transfer occurred.

(End of the CalBRE Reference Book excerpt)